Optimising your debt collection

In an economic environment where cash is king, every day counts. In Luxembourg, debt collection strategy is a combination of legal rigour, anticipation and agility. How do you transform an unpaid debt into a sustainable performance lever?

The cost of time : Anticipating to preserve cash flow

In the life of a company, an unpaid bill is not just an inconvenience: It is a cash tie-up, an imbalance in the value chain, and even a weakening of development.

The key? Never wait.

A customer who is late with a payment is not always acting in bad faith; but the longer the delay, the more uncertain collection becomes. A clear internal policy (solid general terms and conditions, scheduled reminders, precise accounting monitoring) is the first line of defence.

Essential legal levers: Act before prescription

Fast action is not just common sense: it has legal implications.

In Luxembourg, the limitation period for most commercial claims is ten years. Certain claims, particularly wage claims, are time-barred more quickly.

Any legal action or written acknowledgement of debt interrupts this period and starts it again from zero. If you wait too long, you run the risk of seeing your debt definitively extinguished but also irrecoverable.

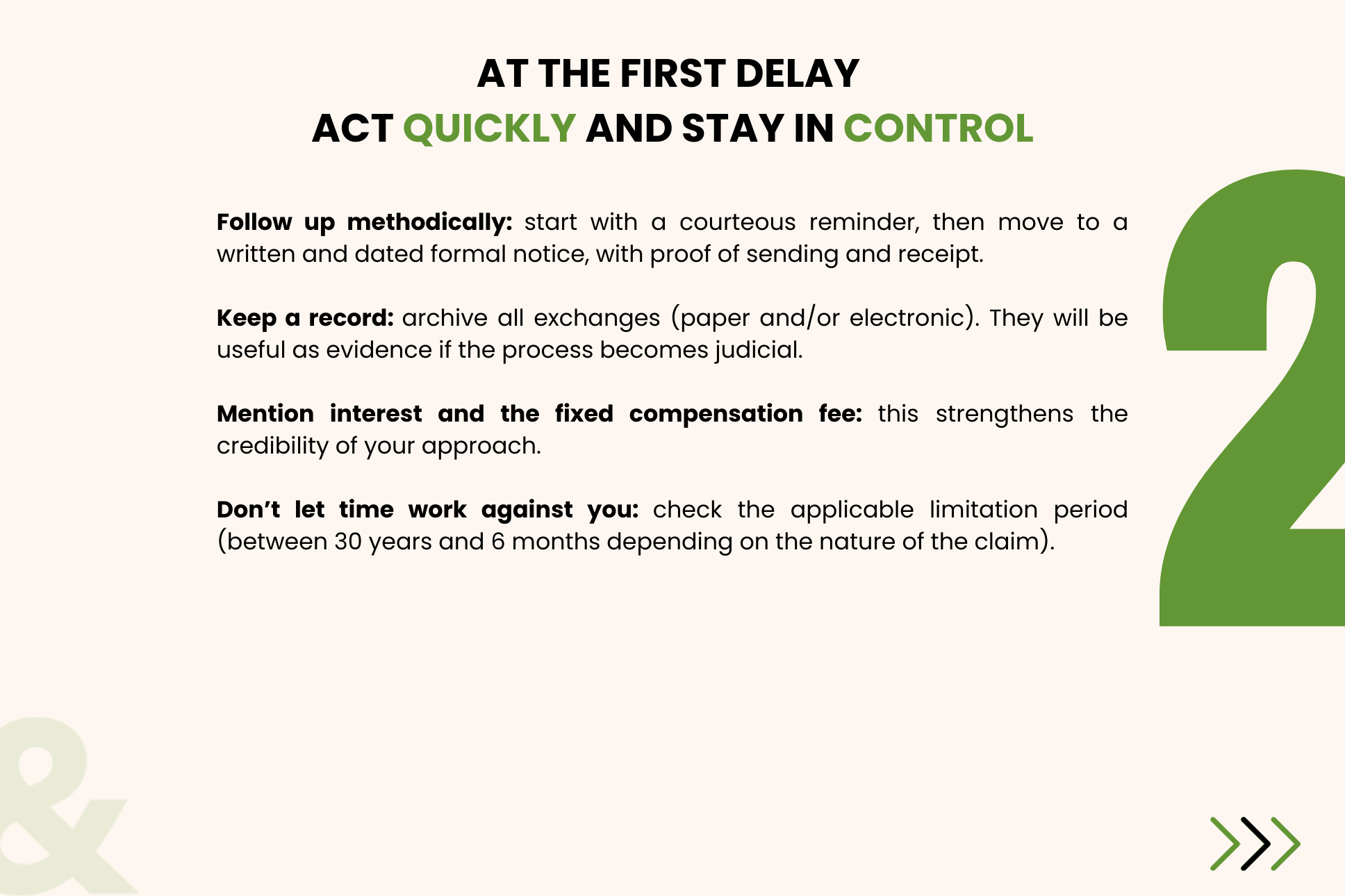

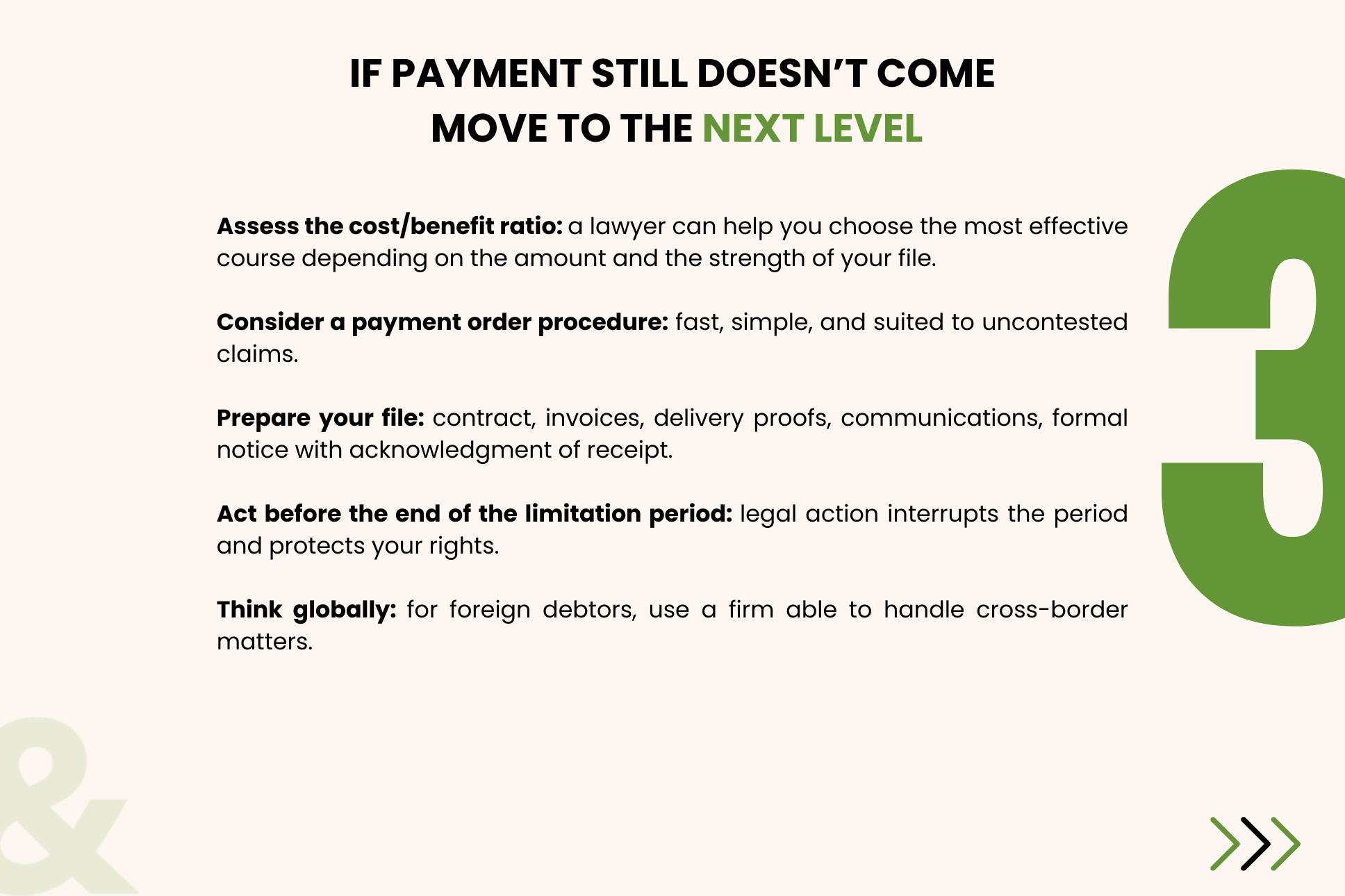

In practice, the process follows three stages:

1. Amicable reminder and formal notice, with documented exchanges;

2. Simplified procedure before the Justice of the Peace (payment order) for certain and not very contestable claims;

3. Litigation procedure (summons, bankruptcy) for complex or important cases.

Well conducted, swift action protects your rights and often creates the jolt needed for a voluntary settlement.

The firm’s strategic approach: method and innovation

Each collection case deserves a tailored approach. At our firm, we give priority to an in-depth analysis of the context: the nature of the debt, the commercial relationship, the debtor’s solvency and the financial impact for the client.

This rigorous method enables us to define the most effective strategy: amicable reminders, targeted legal action or supervised negotiation.

Our innovation lies in the way we manage the case: fluid communication with the client, anticipation of risks, and close coordination between the legal and accounting teams.

Rather than multiplying tools, we focus on responsiveness, clarity and transparency to secure each stage of the collection process and optimise the results obtained.

A firm with an international outlook

Luxembourg is a nerve centre for business. Many of its claims have a multilingual and cross-border dimension.

Our firm assists companies in their dealings in French, English, German, Luxembourgish, Portuguese and Italian, facilitating exchanges with debtors, courts and foreign partners.

This linguistic and cultural capability enables us to ensure smooth, rapid and secure debt recovery, including in complex or international contexts.

Conclusion: act early, act right

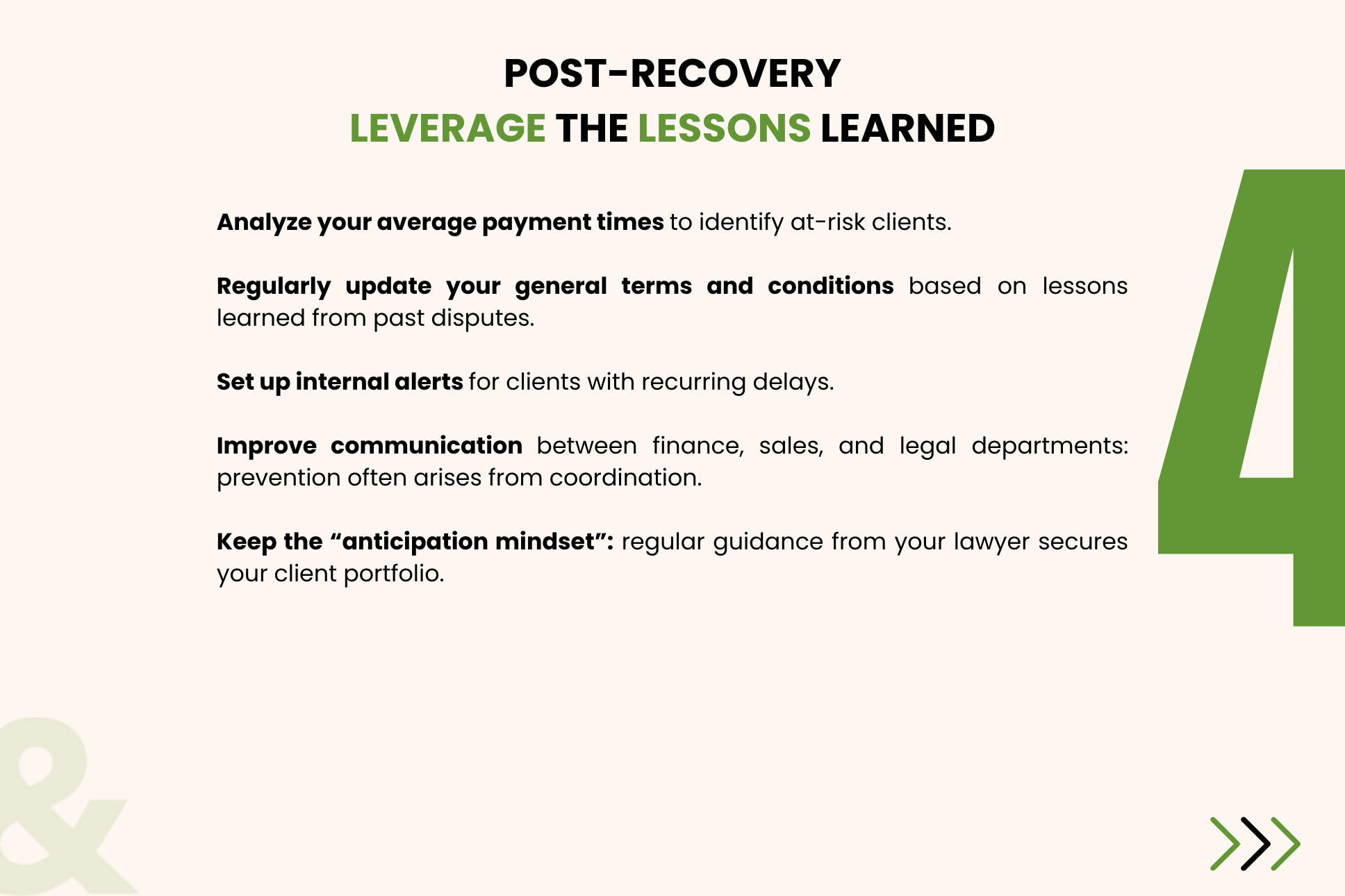

Effective collection is not just based on firmness, but on strategy, anticipation, responsiveness and knowledge of the Luxembourg terrain.

A well-prepared case is better defended; a lawyer involved from the earliest stages increases your chances of success.

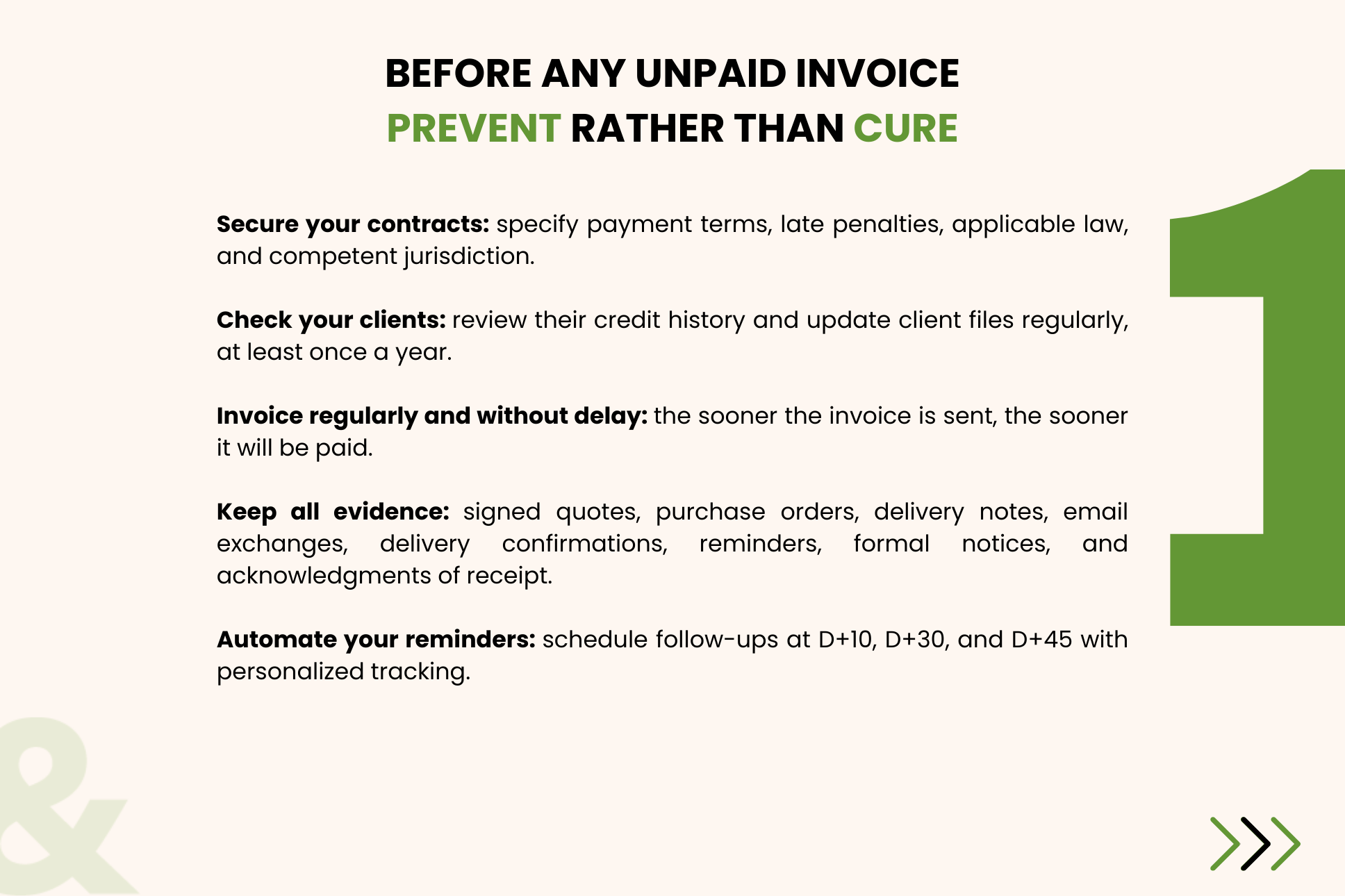

To support this approach, we have devised a practical step-by-step methodology to structure your actions and anticipate the essential points of recovery.

PDF version of the checklist: click here.

In a world where every day of delay has a cost, calling on an expert and agile team means investing in the solidity of your cash flow.

With this in mind, a series of podcasts is available on our website as well as on all your listening platforms, and will allow you to explore these complex issues in an accessible and rigorous way.

For all your debt collection needs, the law firm Brucher Thieltgen & Partners is able to assist you. Do not hesitate to contact our experts:

- Philippe Sylvestre, Partner : philippe.sylvestre@brucherlaw.lu

- Gladys Giudici, Counsel: gladys.giudici@brucherlaw.lu

- Elodie Lemagnen, Senior Associate: elodie.lemagnen@brucherlaw.lu